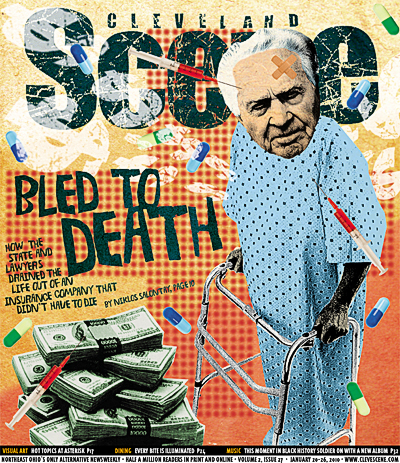

Unfortunately, such incredible costs and time commitments involved in the liquidation of an insurance company are the norm in Ohio. In fact, PIE’s liquidation was fairly prudent compared to others. When the Ohio Insurance Liquidator, which is essentially part of the Ohio Department of Insurance, liquidated the Credit General Insurance Company, a much smaller company than PIE, they managed to drain over $60 million dollars from its $124 million of assets just in legal fees, consulting fees, professional fees and compensation for liquidator employees between January 2001 and June 2009. That means those involved in the liquidation of Credit General paid themselves approximately $28,000 per working day for eight-and-a-half years from the assets of Credit General to liquidate the company. That liquidation is still open. In comparison, the liquidators paid themselves only about $8,000 a day to liquidate PIE between March 1998 and June 2009.

With so much money to be made, it’s not surprising liquidations take so long.

“It usually takes 15-16 years,” Tom McManamon says, “because the lawyers, the consultants, the Department of Insurance, the Liquidator’s people — they feed off this carcass and the longer they can feed off this carcass the better it is [for them]… It would seem that they are not accountable to any higher authority… The liquidator has unlimited power." — Niklos Salontay