Payday loans can be your safety nets in financial emergencies. Not only because you can apply with bad credit, but it also provides instant approval. It is easy to find countless websites to connect you to direct lenders for the loans. However, be careful on which platform to choose, so you can get your loans most beneficially and stay secure with the transaction. Here are a few you should consider:

- iPaydayLoans - Convenient Platform to Connect With Countless Direct Lenders

- WeLoans - The Most Secure and Reliable Broker for Online Loans

- USBadCreditLoans - Helpful Loan Brokers for People with Bad Credit Scores

- CashAdvance - Free Website to Get the Best Payday Loan Offers.

Even small payday loans online with bad credit that you plan to take on short-term should be well-considered. The right platform will connect you to trustworthy direct lenders. Thus, you can get the best loans most securely and conveniently. Let's take a closer look at each of your options.

iPaydayLoans

iPaydayLoans is one of the best platforms to consider to get loans. One application submitted on the website will connect you to multiple direct lenders with various loan offers. Feel free to read and compare before choosing the best you can get. All procedures are 100% online and can take even less than a business day to get your contract settled.

Pros:

- Connect to more than 100 direct lenders in the system.

- On-screen loan offers with detailed terms and information to compare each other.

- Funds can be ready in the next 24 hours after signing the loan contract with the direct lender of your choice.

Cons:

- The loans might not be accessible in some states

- Most loans are only available in the short term.

- Fees and interest rates are high for people with bad credit scores.

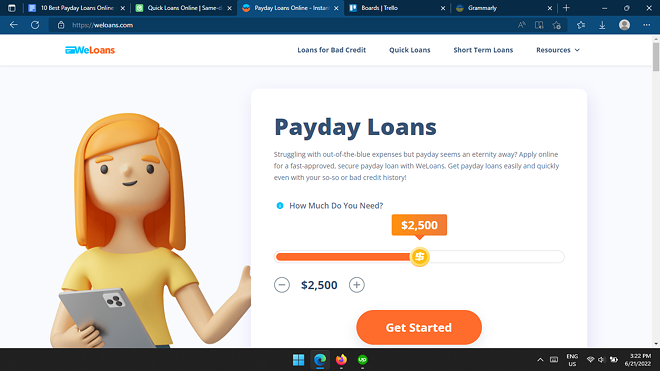

WeLoans

As one of the most secure loan brokers with a fully online process, WeLoans connects you with authorized direct lenders for various forms of loans. Payday loans online with bad credit and instant approval are available with flexible repayment terms and competitive rates. The platform is also known for its high approval rates, even for people with bad credit scores. Most cases of rejection are due to false information submitted during the application process.

Pros:

- High-security protocols on the website

- Multiple forms of loans up to $35,000 are available to cater to various needs and situations.

- With no credit checks, most people who apply will get approved.

Cons:

- Some loans may not be accessible in several states.

- Choosing a loan offer with a longer-term may cause you to spend more money on interest rates and fees.

USBadCreditLoans

While most banks will reject loan applications from anyone with less than 640 credit scores, USBadCreditLoans takes requests from these people. Their lenders will analyze your affordability based on your reliable income and assets, if any. Everybody may borrow up to $5,000 even if their credit scores are lower than 500 because not all lenders do hard credit checks. Instead, most direct lenders consider your financial capability based on your current income and assets.

Pros:

- No extensive credit checking, thus making it possible for people with bad credit scores to get approved.

- The approval process takes very little time.

- Top-notch security as the website does not keep a record of your information and only sends your data to the direct lender you connect to.

- Provide low-rates installment loans.

Cons:

- Loan offers for people with bad credits usually have higher interest rates, especially if the borrower prefers a longer repayment term.

- Longer terms will make you spend more money because the interest rates may eventually add up.

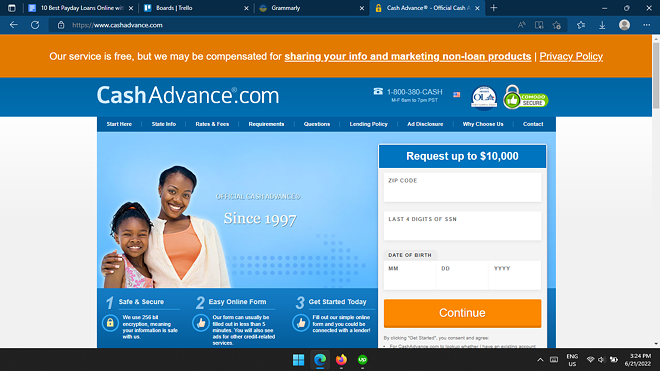

CashAdvance

While most platforms offer up to $5,000 of payday loans, CashAdvance can help you get up to $10,000 on your instant online loans. Repayment plans are flexible, ranging from 7 to 365 days, which you can freely adjust to suit your capability. Direct lenders will give you offers with terms and conditions disclosed. Be sure to read carefully before accepting one of them.

Pros:

- Can borrow up to $10,000, which is generally higher than other brokers

- The website offers a free service to connect you with potential direct lenders that will present you with loan offers.

- The clean and easy website interface makes it easy for people to navigate as needed.

Cons:

- Residents from several states might not be permissible by the law to get approved for short-term loans.

- You may also receive unsolicited offers of other credit-related services, such as debt relief and credit repair.

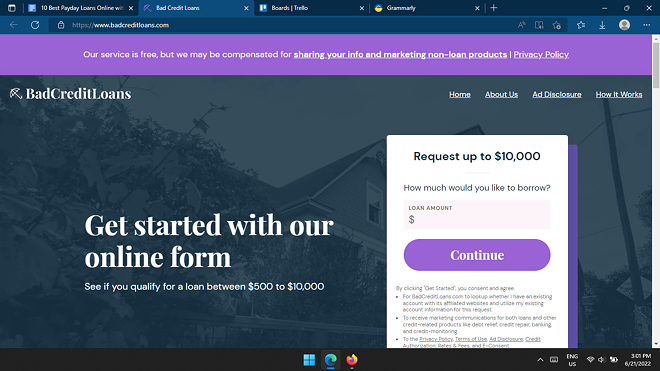

BadCreditLoans

If you have bad credit scores but need a large amount of money, BadCreditLoans can be your answer. This platform allows you to apply up from $200 to $10,000 of loans, which you can pay off in a term of up to 72 months if necessary. It even has competitive interest rates and an APR of less than 36%. This level of flexibility can help people in financial struggles to get out of their difficult situations without feeling the burden of repayments.

Pros:

- Longer terms and flexible repayments can be significantly helpful for underprivileged people.

- An instant and fully online process where you can get your funds ready on the following business day.

- Rates are relatively lower compared to other brokers that offer loans for bad credits.

Cons:

- The application process is comparatively longer than other online brokers.

- Expect to receive other non-loan financial products, such as credit monitoring and debt relief services.

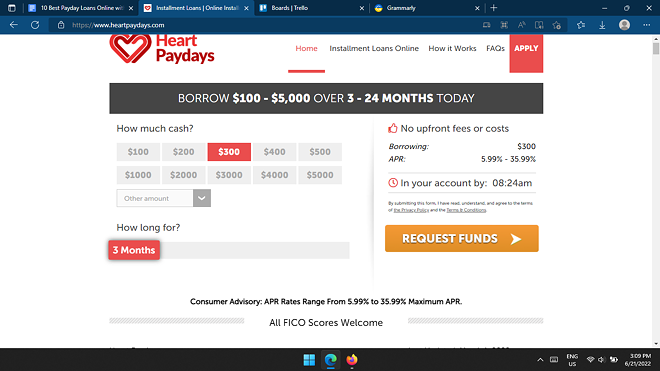

Heart Paydays

Anyone needing a payday loan with flexible repayment can consider Heart Paydays. To borrow up to $5,000 there, you have the option to either pay off in lump sum or spread it in chunks to lower your financial burden. The loan term may span from 2 to 24 months with the APR also ranging between 5.99% to 35.99%. For people with tight monthly budgets, the ability to adjust their repayment is crucial.

Pros:

- Flexible repayment to adjust the various level of affordability

- Many types of loans are available to match your unique financial circumstances.

- Some loans are possible to get the funds available on the same day

- The website has a user-friendly and straightforward interface

Cons:

- Some lenders require deeper credit checkings

- There might be hidden fines if you decide to pay off your debts earlier than scheduled

- Interest rates are even higher if you choose longer terms for your repayments

CashUSA

Yet another platform for the best payday loans to trust is CashUSA. With industry-standard encryption and an efficient interface, the website offers quick and effortless loans up to $10,000. This platform is also known for its large board of reliable lenders, and you will connect to them all after a single loan request submission. The whole process is pretty quick that it is even possible to get your money ready on the next business day.

Pros:

- Competitive interest rates and flexibilities compared to other online loan platforms.

- An extensive network of direct lenders to compare with each other.

- People with no employment status may still get approved as long as they have stable sources of income.

Cons:

- Besides the payday loans of up to $10,000, there are no other types of loans with higher amounts.

- Lenders may require credit checking to consider your approval besides looking into your current income.

PersonalLoans

From traditional to modern lenders, PersonalLoans may connect you to various types of lenders in the system. After your online application, you can look into their loan offers directly from the screens. The types of loans available for applying are varying too, making it easier to find the financial solution that suits your existing situation the most. Even more, you can expect the money to be ready in your account in one or several business days.

Pros:

- Multiple types of loans to choose from can provide you with up to $35,000

- Fair interest rates and fees with flexible terms of repayments to decrease the financial burden

- Most lenders charge no penalties for early repayments, allowing you to be debt-free sooner with no regret.

Cons:

- The website may contain ads for credit-related services, such as debt relief and credit monitoring.

- Some lenders run a hard credit checking, which may affect your chance of getting approved if your credit score is bad.

MoneyMutual

The simple-to-navigate website of MoneyMutual allows you to connect to over 60 lenders by submitting only one online loan application. There are also multiple forms of loan services available ranging from $200 to $5,000. Not only is the approval quick, but you can also expect the money to be readily available within 24 hours from your initial application. Thousands of people have trusted MoneyMutual to find them reliable loans.

Pros:

- The website has top-notch security protocols, and the company is highly reputable, guaranteeing the safety of your data.

- It only takes a few minutes to finish your online loan application form and receive the approvals from direct lenders.

- All offers come with detailed important information regarding the loan, including interest rates, terms, penalties, etc.

Cons:

- While there are many forms of loans to choose from, they only offer small loans with a maximum possible amount of $5,000.

- Due to different local regulations, some loans might not be available in several states.

CocoLoan

When in urgent need of money, CocoLoan can also be another online platform to connect you to countless lenders securely on board. Many types of loans are available there for you to choose from. With a straightforward interface and advanced security protocols, applying for loans is effortless and quick. Once you sign a loan contract there, your lender will make the funds available to your checking account in no more than two business days. Like most other loan websites, CocoLoan welcomes people with bad credit scores to apply.

Pros:

- Most loans allow lenders to transfer the funds within the same day of the contract signup.

- Loan offers with tailored terms and credentials to match your financial capability to make sure you can afford the repayment.

- Plenty of loan options with detailed information, thus making it easier for you to consider and choose.

Cons:

- Very limited amount of loans for applicants with bad credit scores.

- Some loans are restricted in some states due to different regulations.

FAQs

What are the best payday loans with bad credit?

The best payday loan with bad credit is the one that provides the most security. It will also be bonus points if the platform offers speed and convenience in the process. WeLoans may be your best option to consider as the website is safely protected and the approval process is pretty fast.

Can I get a payday loan with bad credit?

Due to the regulations in the US, payday loans with bad credit are impossible. But, you can find many lenders that only require soft credit checking. Many lenders are willing to provide loans for people with bad credits as well. They will use your information regarding your income and assets to analyze your financial capability to handle your repayments on time.

Is it easy to apply for payday loans with bad credit?

Sure, it is. You don't need to leave your house or waste your time submitting your requests to multiple lenders. The application process is fully online and may take only a few minutes to finish. You will even receive the offers and proceed with your contract through the internet as well.

Are there any costs for using these online loan companies?

The broker websites do not charge you for browsing or applying for a loan. You would not need to pay a dime as well if you decide to reject all the loan offers you receive afterward. However, the loan contract you agree to sign usually includes fees and interest rates. Lenders will always disclose such information when offering loans. Be sure to read thoroughly.

How do I repay a loan?

Each loan offer has specific terms and schedules for repayments. You can either pay it all at once in a lump sum or spread the installments in months to make it less burdensome. Many lenders take online transactions for the repayments, which you can set to be automatically deducted from your bank account as well. Extra charges may apply if you are late or even decide to pay off your debts earlier.

Conclusion

Payday loans from direct lenders are one of the best get-go options for various financial emergencies. Moreover, many websites can connect you to multiple direct lenders by one online application so you can compare and choose between loan offers. Nonetheless, not all platforms are the same. Many factors you must consider before choosing which website to apply to.

Make sure the website has advanced security protocols to ensure your data safety and privacy. The loan amount you possibly get, repayment terms, and interest rates are also crucial to calculate, especially if you have a bad credit score. Of course, it will be even better if the funds can be available in 24 hours.

Finding the best broker for payday loans online with bad credit instant approval is crucial. This way, you can reap the most benefits without spending too much on unnecessary expenses and disadvantages.