Regardless of how strategically you plan finances, there are times when you need cash-strapped and need urgent funds. We all have been there at least once in a lifetime when we have to get Pay Loans UK.

While good credit score holders have nothing to worry about same-day loans. People with bad credit scores might have sleepless nights, as they can’t borrow money in conventional ways like banks and financial agencies. Well, there is a silver lining for them and it’s a bad credit payday loan.

In this post, we bring some of the best UK payday loan bad credit providers to your attention.

- Fast Payday Loans – Get instant payday loans for bad credit score holders in minutes!

- Payday Loans UK – Enjoy payday loan funding for bad credit at PaydayLoansUK!

- UK Bad Credit Loans – Obtain payday loans for bad credit from lenders connected by UK Bad Credit Loans!

- Get Payday Loan – No harsh credit check is a promise with payday loans direct lender connected here!

Fast Payday Loans

It's hard to beat what Fast Payday Loans is offering as this online direct lender broker platform doesn't discriminate based on credit score. As low as a 350 score is also accepted. Its modus operandi is quick and flawless. There is not much information to provide.The website has a very user-friendly interface that can be used easily by any non-tech-savvy person. If you've any troubles then you've got the aid of experienced customer assistance.

The team will guide you at every step. A payday loan is not the only online financial assistance that you can avail of with Fast Payday Loans. You can get quick loans, small day loans, no credit check loans, no guarantor loans, and many more kinds of loans from the platform.

Pros

- Perfect lender-borrower match

- Customised quotes for payday loans

Cons

- Approval takes time if the amount is huge

UK Payday Loan at Zero Processing Fee - Fast Payday Loans >>

Payday Loans UK

If you’re looking for a same-day loan with bad credit then try Payday Loans UK.

With its extensive network of direct lenders in the UK, the platform promises to provide immediate funding. Indeed it keeps its promise as many borrowers get money in their accounts within 24 hours. It can help you borrow anything from £50 - £5,000 without being worried about your credit score.

What makes thousands of money-seekers bank upon this option is its tailor-made quotation. Your requirements are certainly taken into consideration before offering a quote. Hence, most of them get what they were seeking.

Pros

- A wide range of loans are offered

- 24*7 availability of direct lender payday loans and support

- Any bad credit score is accepted

Cons

- A huge amount takes more than a day to be credited

Try it for least-risk payday loans in the UK at Payday Loans UK >>

UK Bad Credit Loans

UK Bad Credit Loans is a professional UK payday loan broker that is worthy of your time and trust because of its swift and hassle-free payday loan processing. You don’t have to think twice about a bad credit score before applying for a payday loan UK as it’s not bothered about it. Whatever number you own, you can go ahead with confidence.

It will help you connect with UK direct lender network instantly.

Even though the process is entirely simple, there is a customer assistance team to help you if you face troubles at any point. We loved the way this UK payday loan broker has maintained transparency. There is no additional or hidden fee charged.

Pros

- Allows the borrower to send more than one quote to a payday loan direct lender

- Provides payday loans without any guarantor

Cons

- Hasn’t revealed the loan application processing time. It could even take days for the amount to get credit if it’s huge.

UK Bad Credit Loans for all kinds of payday loans with bad credit requirements >>

Get Payday Loan

Get Payday Loan has been made into the list because this service provider took strict security measures to ensure that every transaction remains secured.

The website is backed with military-grade encryption. Also, the broker maintains data secrecy. It’s confirmed that none of the critical financial information is shared with other third-party services. This assures UK payday loan seekers that information like bank account number, correspondence number, and credit card details are in safe hands.

Pros

- Assured quotes for all bad credit score holders

- Multiple payday loans in the United Kingdom quotes for on request

- Authorised to grant payday loans in the UK by Financial Conduct Authority

Cons

- There is no live chat facility

Connect with verified payday loans UK direct lenders instantly on Get Payday Loan >>

Easy Payday Loan

If you’re looking for a long repayment period on your UK payday loan then try Easy Payday Loan right now. This direct lender loan provider platform removes the hassles included in the process and makes it as smooth as possible. It’s a fully regulated and FCA-authorised online network of payday loan bad credit direct lenders that are willing to offer immediate financial assistance.

This online pay-day loan broker has strict policies for lenders to be a part of its direct lender network in the UK. So, there is no way that you’ll get duped or dumped. With a promise of customised quotes, Easy Payday Loan is here to help bad credit score holders.

Pros

- Quick approval after an easy loans UK payday application process

- Anyone above 18 years and having a British bank account holder can go for payday loan

Cons

- It’s mandatory to have a regular job to avail of the same-day loan

Visit Easy Payday Loan - The best and hassle-free payday loans UK Platform >>

WeLoans

WeLoans is a preferred payday loan bad credit direct lender network if you need to borrow a high amount via payday loans in the UK. It allows you to raise quick funds to £5,000 without any harsh credit history check.

We Loans won’t ask a single question about your money needs and credit history. Its extensive partner-lender network is spread all across the UK. More than 150 direct lenders are part of its network. So, wherever you are, you’ll be able to get instant funds. Each lender becomes a part of the network only after careful verification.

The payday loan UK application form is very detailed and provides crucial information about the borrower. For instance, details like current financial situation, credit scores, and employment status are provided.

Pros

- Money transfer within 24 hours

- No confusing terms for payday loans near me

- 256 Bit encryption and SSL certificate

Cons

- Some might think that too much information is asked

We Loans - Ideal solution to get a payday loan in your place >>

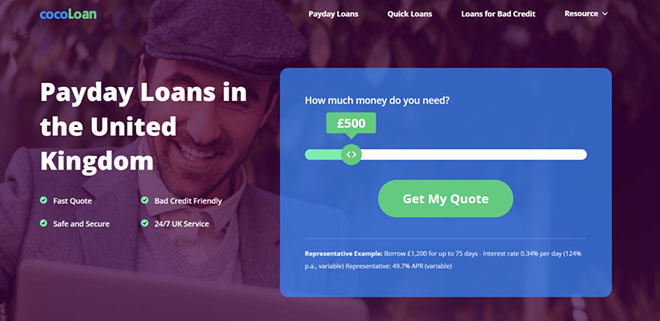

CocoLoan

CocoLoan is a fast and secure way to connect with payday loan direct lenders in the UK and get immediate financial assistance. The online UK payday loan broker platform adopts a proactive approach and provides instant quotes and payday loan approval. As there is an advanced AI at work, it will hardly take a fraction of a second to connect with your FCA-approved direct lenders.

The platform itself is FCA-authorised and adopts the best data-protection practices. Hence, you have nothing to worry about. There would be a soft credit check performed before you accept a quote. This is done for the peace of mind of the lenders. However, all bad credit score holders are allowed to raise a request. There are no restrictions imposed on this front.

Pros

- The offer provided is no obligation and acceptance isn’t forced

- Least-possible paperwork

- Reliable payday loans direct lenders UK on the platform

Cons

- A credit check will be done for sure before you get the payday loan online

Try Coco Loan for a hassle-free payday loan on the same day >>

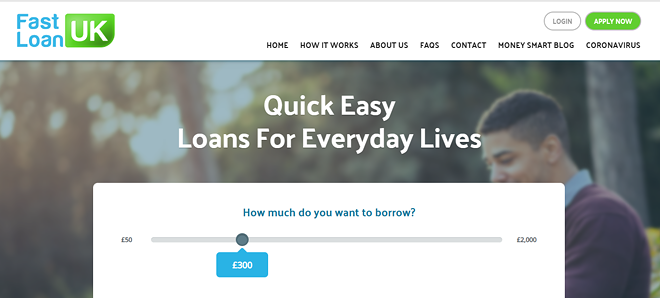

FastLoanUK

FastLoanUK is a great choice to make if you’re ok with a soft credit check as this platform performs it for new customers. However, it doesn’t mean that people with very low credit scores can’t apply or connect with payday loan direct lenders UK easily.

It’s the ideal place to be when you need quick and hassle-free same-day loans up to £2,000. However, if you’re a new customer, the maximum amount that you can borrow from this platform is £800.

It’s one of those pay-day loans UK providers that provide detailed customer assistance. A customer care team will pay attention to your money-borrowing needs and help you get a customised solution. The FAQ section is quite extensive as well.

Pros

- A wide range of repayment facilities are offered; one can pay weekly, fortnightly, or monthly

- Around-the-clock customer assistance is offered

Cons

- The interest rate is fixed and is high; you have to pay 151.4% p.a interest rate on payday UK loans

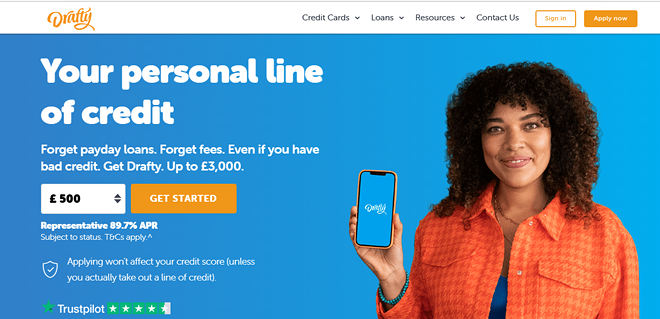

Drafty

Drafty is a platform that claims to offer an affordable version of payday loans in the UK. It’s not exactly a payday loan. But, it’s here to help you in times of dire money needs. It’s an FCA- approved platform that helps UK people to get a secured and swift line of credit. One can get as high as £3000 with a bad credit score.

The best part of this service is that the interest is charged on the amount consumed or used. For instance, if you borrowed £2,000 but used only £1,500 then you have to pay interest only on the latter amount; not on the amount that you borrowed.

Pros

- No fixed terms for repayment, You can repay as you draw.

- Repayment terms are decided as per the borrower’s capabilities

Cons

- Responses from lenders are late at times

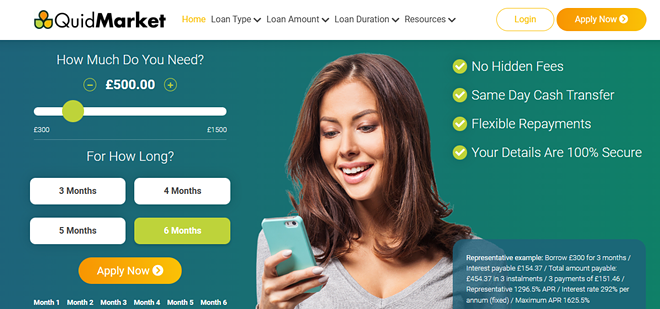

QuidMarketLoans

We suggest QuidMarketLoans for same-day payday loans in the UK if the borrower is seeking great flexibility. This platform lets you define the money you want to borrow and the time duration.

The platform is utterly secured as the industry’s best customer data safety measures are at work. If you’re a new customer then you will have a repayment period of up to 6 months, which is great. But, the platform values its existing customers more as time can be provided for repayment.

You can have faith in its direct lenders UK network as all of them are FCA authorised and have an impressive lender profile.

Pros

- A long history of successful payday loans UK approval

- Quotes are created by humans, not by bots

Cons

- Loans requests above £1,500 are generally not acceptable

FAQs

Q1: How does payday loan work in the UK?

Payday loans in the UK are a type of financial tool that works like small and instant assistance at a high-interest rate. This type of financial assistance came into being in 1900 in the US and is regulated by the FCA or Financial Conduct Authority. The body defines the rules for this loan and every service provider must adhere to them.Payday loans in the UK are used when one needs short credit immediately. It’s helpful when the borrower has no impressive credit score history and fails to get financial assistance from traditional money-borrowing options like banks. The borrower has to pay back the money when the salary is received. One can repay the amount in a couple of months. Instant repayment isn’t offered. The interest rate on a payday loan is higher than on other kinds of loans.

Q2: Can UK payday loans take you to court?

Yes, you can be behind the bar if you take a payday and don’t reply at all. We all know that payday loans are offered at a high-interest rate.

For a few, this rate can become unbearable and lead to non-payment. The lender can allow more time to repay. But, if you’re not that lucky then the lender can sue and you have to visit court for the processing and other stuff. It’s crucial to learn about the payday loan terms and conditions before availing of it. Even if the amount is small, the lender can send you a court order for being a defaulter or not repaying the amount.

It’s not the borrower that will have legal implications. A lender can also be dragged to court if s/he isn’t operating without obtaining a licence. Any lender has to obtain a licence to operate. If a customer finds out that you’re not licensed then s/he can file a complaint and you can receive a court order.

Q3: Can I stop payment on a payday loan?

Yes, you can stop payment of payday loan UK if situations like lack of funds or full repayment take place. Also, if you’ve set an automatic payment deduction feature on your account then also you can stop the payment or change the settings.

You can stop the lender from withdrawing money from your accounts. In the case of an automatic amount deduction facility, you must have signed a payment authorization known as ACH authorization. You need to disable this on your account to stop a payment. If you’ve made the payment via cheque then you can call your bank to hold or cancel it. For instance assistance, you can use a net banking facility. In the Account>Transaction section, you will get the opportunity to cancel a check immediately.

Q4: Is a payday loan in the UK secured or unsecured?

Payday loan UK is unsecured. By unsecured loan, we meant a loan that doesn’t ask for any collateral for approval. But, this leads to an exorbitant loan processing fee and interest rate. This is done to protect the rights of the lender and provide security, in case a borrower becomes a defaulter. You will get the funds immediately at a higher repayment charge.

You can approach direct lenders for a payday loan through reliable platforms. As the loan is unsecured, there is no need to keep any asset as collateral. Also, it won’t require any credit history check. All these things make it a quick way to get financial assistance.

Q5: How long will a payday loan stay in the system?

A payday loan is in the system for a very long time. Lenders and borrower details remain in the system for nearly 6 to 10 years.

Credit bureaus will keep the payday loans online details secured. The database is maintained to keep track of defaulters and fraudsters. As far as mentioning payday loans on a credit report is concerned, it will display for six years. If you have made repayments as per the schedule then it can improve the overall score.

Conclusion

Payday loans can help you solve any untimed financial requirements. With bad credit score holders, this option can be of great help as bad credit won’t get you a loan from a bank. However, one has to play smart as payday loans in the UK come with a high-interest rate and can put you in a trap.

It’s essential that you take the help of a trusted service provider that maintains transparency in the operation. We discussed the best players in this industry that have already helped thousands of people to get out of the financial crunch through direct lender loans. Try them out today and you will surely have a smooth payday bad credit loans UK processing experience.