Opportunity Zones Will Only Enrich Investors if There's Not Concerted Push for Equity

By Sam Allard on Fri, Sep 21, 2018 at 1:00 pm

[

{

"name": "Ad - NativeInline - Injected",

"component": "38482495",

"insertPoint": "3",

"requiredCountToDisplay": "5"

},{

"name": "Real 1 Player (r2) - Inline",

"component": "38482494",

"insertPoint": "2/3",

"requiredCountToDisplay": "9"

}

]

Investors nationwide are rubbing their hands together as they wait for a full set of rules from the U.S. Treasury regarding Opportunity Zones, the new Federal tax incentive that targets high-poverty census tracts for economic development. Investors will be able to postpone or forego capital gains taxes if they invest those gains in the zones, or else put that money into "Opportunity Funds" created for such investments.

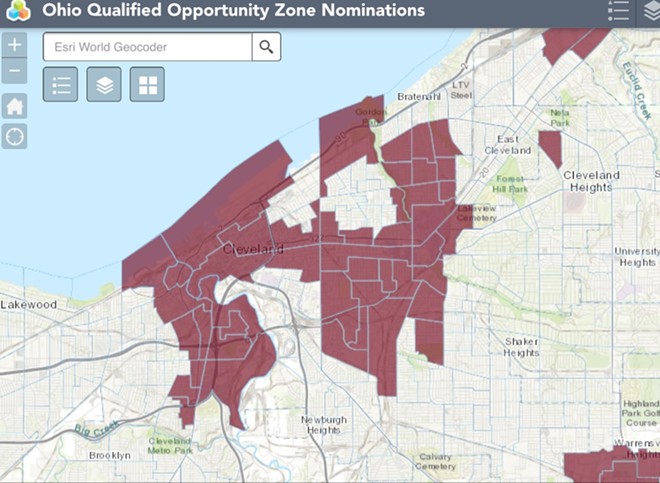

In Cleveland, a cohort of leaders are trying to ensure that the majority of these dollars don't flow into already prosperous areas. Parts of Tremont, Ohio City, Downtown and University Circle are among the local designated Opportunity Zones. They were selected based on input from the city of Cleveland, Cuyahoga County and a handful of local economic development organizations, including the Greater Cleveland Partnership and the Fund for Our Economic Future.

The think tank Policy Matters Ohio, in a report published this week, said that the tax incentive might enhance poor communities, but unless the program is implemented carefully, it could also increase inequality.

The program is intended to direct the investment of capital gains, 64 percent of which, in Ohio, belong to the richest one percent of tax filers, (average annual income of $1.2 million or higher). They'll benefit greatly from the tax cut. But as Policy Matters reiterates, tax cuts drain scarce resources from the public sector, which, unlike investors, isn't focused on maximizing its profits to the exclusion of all other considerations.

"The effect on low-income residents of Opportunity Zones is less clear," Policy Matters writes. "Tax incentives have not been very effective in creating jobs. Investment capital does not address the pressing needs of people living in or near poverty. Pricey new residential development could force rents up and drive some low-income residents out of their neighborhoods. Cuts to food aid and health care that federal legislators are considering to pay for last year’s tax overhaul (including the Opportunity Zone program) would hurt low-income families. Reporting requirements, transparency, local oversight and enforceable community benefit agreements should be an essential part of the program to ensure residents are helped and not harmed."

One likely outcome is that, without intervention and safeguards, investors will merely flock toward the highest possible returns and pour money into projects like nuCLEus, the Quicken Loans Arena and the Flats East Bank, all of which already have received (or could potentially receive) significant public subsidies and are also located in Cleveland's Opportunity Zones.

Earlier this month, in a summit about the Zones, roughly 100 public, private and nonprofit leaders gathered to discuss strategies for ensuring sustainable, equitable development. Writing about that summit for the Brookings Institute, Rachel Barker and Alan Berube noted that investors do tend to seek out projects with higher projected returns. This is a no-brainer.

"In Cleveland, for example, the typical home value in Opportunity Zone communities ranges from just $52,000 [around] the Opportunity Corridor, to $137,000 in Ohio City/Tremont/West 25th Corridor. As one expert noted, this dynamic could lead to just 10 to 15 percent of the “hottest” Opportunity Zones capturing the lion’s share of investment. Preventing this outcome, and ensuring that Opportunity Zones deliver a social benefit commensurate with the revenues that the U.S. Treasury foregoes, won’t happen by chance."

So there needs to be a concerted effort around "truly equitable investment," said Brad Whitehead, President of the Fund for Our Economic Future, when Scene asked about the summit and its key takeaways.

Though all the rules aren't out yet, Whitehead said there are a number of strategies that economic development organizations can pursue, including identifying investors across the country "who are applying a social lens" to their investments, "utilizing measurement mechanisms to score investments on their social impact," and leveraging philanthropic dollars to "structure deals that make sense both financially and socially."

Whitehead said there are "great minds" thinking about this issue around the country, and it will be critical to work with them as strategies are developed and implemented.

In Cleveland, a cohort of leaders are trying to ensure that the majority of these dollars don't flow into already prosperous areas. Parts of Tremont, Ohio City, Downtown and University Circle are among the local designated Opportunity Zones. They were selected based on input from the city of Cleveland, Cuyahoga County and a handful of local economic development organizations, including the Greater Cleveland Partnership and the Fund for Our Economic Future.

The think tank Policy Matters Ohio, in a report published this week, said that the tax incentive might enhance poor communities, but unless the program is implemented carefully, it could also increase inequality.

The program is intended to direct the investment of capital gains, 64 percent of which, in Ohio, belong to the richest one percent of tax filers, (average annual income of $1.2 million or higher). They'll benefit greatly from the tax cut. But as Policy Matters reiterates, tax cuts drain scarce resources from the public sector, which, unlike investors, isn't focused on maximizing its profits to the exclusion of all other considerations.

"The effect on low-income residents of Opportunity Zones is less clear," Policy Matters writes. "Tax incentives have not been very effective in creating jobs. Investment capital does not address the pressing needs of people living in or near poverty. Pricey new residential development could force rents up and drive some low-income residents out of their neighborhoods. Cuts to food aid and health care that federal legislators are considering to pay for last year’s tax overhaul (including the Opportunity Zone program) would hurt low-income families. Reporting requirements, transparency, local oversight and enforceable community benefit agreements should be an essential part of the program to ensure residents are helped and not harmed."

One likely outcome is that, without intervention and safeguards, investors will merely flock toward the highest possible returns and pour money into projects like nuCLEus, the Quicken Loans Arena and the Flats East Bank, all of which already have received (or could potentially receive) significant public subsidies and are also located in Cleveland's Opportunity Zones.

Earlier this month, in a summit about the Zones, roughly 100 public, private and nonprofit leaders gathered to discuss strategies for ensuring sustainable, equitable development. Writing about that summit for the Brookings Institute, Rachel Barker and Alan Berube noted that investors do tend to seek out projects with higher projected returns. This is a no-brainer.

"In Cleveland, for example, the typical home value in Opportunity Zone communities ranges from just $52,000 [around] the Opportunity Corridor, to $137,000 in Ohio City/Tremont/West 25th Corridor. As one expert noted, this dynamic could lead to just 10 to 15 percent of the “hottest” Opportunity Zones capturing the lion’s share of investment. Preventing this outcome, and ensuring that Opportunity Zones deliver a social benefit commensurate with the revenues that the U.S. Treasury foregoes, won’t happen by chance."

So there needs to be a concerted effort around "truly equitable investment," said Brad Whitehead, President of the Fund for Our Economic Future, when Scene asked about the summit and its key takeaways.

Though all the rules aren't out yet, Whitehead said there are a number of strategies that economic development organizations can pursue, including identifying investors across the country "who are applying a social lens" to their investments, "utilizing measurement mechanisms to score investments on their social impact," and leveraging philanthropic dollars to "structure deals that make sense both financially and socially."

Whitehead said there are "great minds" thinking about this issue around the country, and it will be critical to work with them as strategies are developed and implemented.

SCENE Supporters make it possible to tell the Cleveland stories you won’t find elsewhere.

Become a supporter today.

About The Author

Sam Allard

Sam Allard is the Senior Writer at Scene, in which capacity he covers politics and power and writes about movies when time permits. He's a graduate of the Medill School of Journalism at Northwestern University and the NEOMFA at Cleveland State. Prior to joining Scene, he was encamped in Sarajevo, Bosnia, on an...

Scroll to read more Cleveland News articles

Newsletters

Join Cleveland Scene Newsletters

Subscribe now to get the latest news delivered right to your inbox.